Prelims Exam: Current Events of National and International Importance

Mains Exam: General Studies Paper-2 (Functions and Responsibilities of the Union and States, Government Policies and Interventions for Development in Various Sectors) |

Reference:

Recently, the Central Government has announced the formation of the 8th Pay Commission.

What is Pay Commission:

- The Central Government constitutes the Pay Commission through a resolution proposal to revise the pay structure of its employees and determine pension payments.

- It is an administrative body.

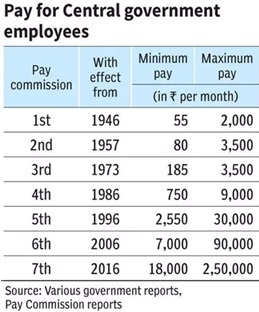

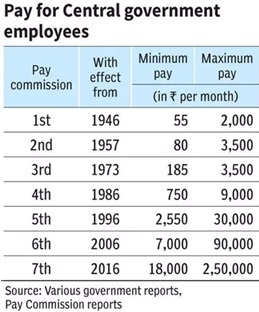

- Under normal circumstances, the Central Government constitutes the Pay Commission every 10 years. Since 1947, seven Pay Commissions have been set up so far.

Structure of Pay Commission:

- One Chairman and two Members

- They are appointed by the Central Government.

- Generally, a retired judge of the Supreme Court is appointed as the Chairman of the Pay Commission.

Functions of Pay Commission

- The Pay Commission consults the Central and State Governments as well as other stakeholders before recommending the pay structure, benefits and allowances for government employees.

- Their recommendations are often adopted by government-owned organisations.

- The Pay Commission recommends revision of the pay and pension structure of the beneficiaries resulting in increase in remuneration and allowances.

- However, the recommendations of the Pay Commission are not binding on the government.

- The 7th Pay Commission was set up in the year 2016 and its recommendations are for up to 31 December 2025.

Basis of salary increase:

- The Pay Commission also suggests the formula for revising the Dearness Allowance and Dearness Relief for Central Government employees and pensioners with the aim of reducing the impact of inflation.

- At present, the minimum wage is determined on the basis of the formula devised by nutritionist Wallace Ruddell Akroyd.

- It was approved in the 15th Indian Labor Conference held in the year 1957.

- This formula was based on the food and clothing needs of the people of a country. It takes into account the changes in the prices of commodities important for the average person which are likely to affect them in the future.

What is Fitment Factor:

- Fitment Factor is a formula used to improve the salary and pension of government employees and pensioners.

- It adjusts the basic salary of the employee to the new pay scale by increasing it by a certain multiplier.

- It is decided on the basis of the recommendations of each Pay Commission.

- The 7th Pay Commission had fixed the fitment factor as 2.57.

- Its main objective is to improve the economic condition of the employees and maintain their purchasing power with the increasing level of inflation.

- The main factors determining the fitment factor are:

- Economic condition of the government

- Inflation rate

- Needs of employees

Effect

On the economy:

- Increase in consumption and production due to salary increase

- Promotion of economic development

On the government:

Implementation of the 7th Pay Commission put an additional burden of Rs 1 lakh crore on the government treasury in the financial year 2016-17. The formation of the latest commission will also increase the financial burden of the government.

On government employees:

- Implementation of the recommendations of the Pay Commission is likely to increase consumption along with improvement in the quality of life of government employees. As a result, production and investment will also be promoted and the effect of inflation will decrease.

Provisions for wage increase for workers in the unorganized sector:

- The Central Government increases the minimum wage rates of workers in the unorganized sector by revising the Variable Dearness Allowances (VDA).

- Its purpose is to help workers cope with the rising cost of living.

- The Central Government revises the variable dearness allowance twice a year (1 April and 1 October) based on the six-month average increase in the consumer price index for industrial workers.

- The minimum wage rates are classified into unskilled, semi-skilled, skilled and highly skilled on the basis of skill levels and are also divided on the basis of geographical areas - A, B and C.

- The minimum wage in India is determined by both the Central Government and the State Government.

Contact Us

Contact Us  New Batch : 9555124124/ 7428085757

New Batch : 9555124124/ 7428085757  Tech Support : 9555124124/ 7428085757

Tech Support : 9555124124/ 7428085757