(Mains GS 3 : Indian Economy and issues relating to planning, mobilisation of resources, growth, development and employment.)

Context:

- Recently, the Goods and Services Tax (GST) Council met over two days in its first ‘regular’ meeting after a nine-month break in Chandigarh.

Exemptions took in place:

- A new ministerial panel is being tasked with figuring out the long-pending constitution of an appellate tribunal for GST disputes, to move ahead.

- Based on an ‘interim’ report of a panel to rationalise tax rates, exemptions have been scrapped on several items and rates altered for others to correct inverted duty structures.

- This may translate into higher prices on many goods and services (and reductions for a few) from July 18, although their impact on inflation is difficult to ascertain.

Compensation requirements:

- To allay the fears of States of possible revenue loss by implementing GST in the short term, the Union government promised to pay compensation for any loss of revenue in the evolutionary phase of five years.

- The five years period ends on June 30, however, the GST Council did not take any call on it. The proposal will likely be taken up again in the next meeting.

- The compensation was to be calculated as the shortfall in actual revenue collections in GST from the revenue the States would have got from the taxes merged in the GST.

- This was estimated by taking the revenue from the merged taxes in 2015-16 as the base and applying the growth rate of 14% every year.

- To finance the compensation requirements, a GST compensation cess was levied on certain items such as tobacco products, automobiles, coal and solid fuels manufactured from lignite, pan masala and aerated waters.

Critical takeaways:

- Apart from the fine print of the Council’s decisions, which include tighter norms on the horizon for registering new firms and closing of tax evasion loopholes, there is a more critical takeaway.

- That the deliberations were constructive and not combative, especially amid the brewing trust deficit between the Centre and States in the past few meetings and the prolonged pause since it last met, bodes well for the necessary next steps to make GST deliver on its original hopes.

- Not a single member raised the recent Supreme Court order that some States believed had upheld their rights against ‘arbitrary imposition’ of the Centre’s decisions in the Council.

Critical forum:

- The States are no longer driven by party whips in this critical forum thus should enrich the quality of dialogue and outcomes.

- That the Centre ‘heard them out’ and left the issue open, unlike the last Council meeting when its response was akin to an outright ‘No’, is most refreshing.

- Taking a clear call, one way or the other, on continuing this support, will be ideal for the Centre and States to plan their fiscal math better.

- Just as sustaining and nurturing this fledgling federal compact is critical to make the GST work better for all, sooner rather than later.

Conclusion:

- Extending the compensation payment for the loss of revenue for the next five years is necessary not only because the transition to GST is still underway but also to provide comfort to States to partake in the reform.

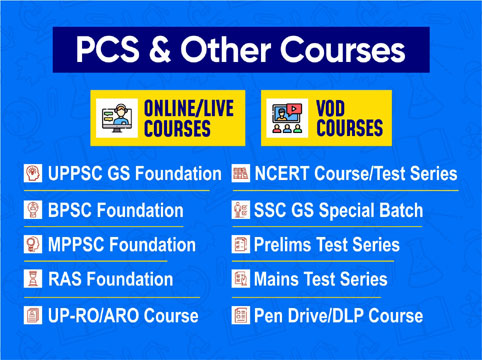

Contact Us

Contact Us  New Batch : 9555124124/ 7428085757

New Batch : 9555124124/ 7428085757  Tech Support : 9555124124/ 7428085757

Tech Support : 9555124124/ 7428085757