(MainsGS3:Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.)

Context:

- India’s Unified Payments Interface (known as UPI) and Singapore’s PayNow were officially connected, allowing for a “real-time payment linkage”.

Cross-border payment:

- On February 21, the Reserve Bank of India Governor, Shaktikanta Das, and the Monetary Authority of Singapore’s Managing Director, Ravi Menon, made token instantaneous cross-border remittances to each other using the Unified Payments Interface (UPI) and PayNow mobile applications on their phones in India and Singapore, respectively.

- Singapore has now become the first country with which cross-border Person to Person (P2P) payment facilities have been launched.

- This will help the Indian diaspora in Singapore, especially migrant workers/students and bring the benefits of digitalisation and FINTECH to the common man through instantaneous and low-cost transfer of money from Singapore to India and vice-versa.

Facilitating economy:

- The transactions marked the start of a cross-border link for real-time person-to-person money transfers between South Asia’s largest economy and its littoral neighbour across the Malacca Strait.

- Singapore is home to a sizable Indian diaspora as well as tens of thousands of migrant workers employed in Singapore’s humming construction, marine shipyard and services sectors.

- The link now enables individuals wishing to remit either Singapore dollar (SGD) or Indian rupee funds for the ‘maintenance of a relative’ or as a ‘gift’ to transfer the money seamlessly using the UPI at the Indian end and the PayNow app at the Singapore end.

Part of wider regional efforts:

- Though a small start, given that the daily transaction limit is set at ₹60,000 or about SGD 1,000, the link is significant in that it enables individuals to quickly and safely remit money to their loved ones without the hassles of having to go to a bank branch or a wire transfer facility’s outlet or having to rely on the higher-cost and riskier ‘hawala’ channels.

- The tie-up is also part of a wider regional effort to facilitate cross-border real-time money transfers in a manner that reduces operational costs for individuals and merchants, while at the same time reducing the reliance on an external settlement currency, which hitherto has predominantly been the U.S. dollar.

- Singapore, which had established a similar payment link with Thailand in 2021, is part of a larger five-member initiative among the central banks of Southeast Asian economies including Malaysia, Indonesia and the Philippines that aims to interconnect their domestic digital payment systems.

- India too could build on the springboard it has gained in Singapore to further its cross-border digital payment linkages and extend the partnership to the city-state’s other Association of Southeast Asian Nations partners.

Conclusion:

- Besides a sure-shot boost to regional trade and tourism, such a network would help India to further formalise the flow of inbound remittances.

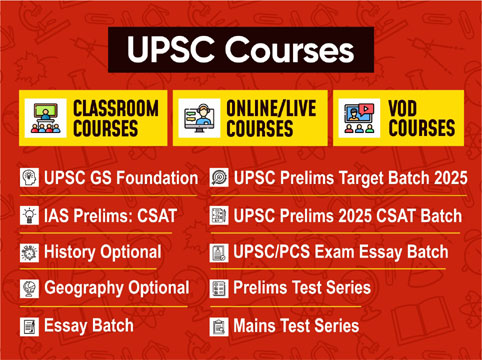

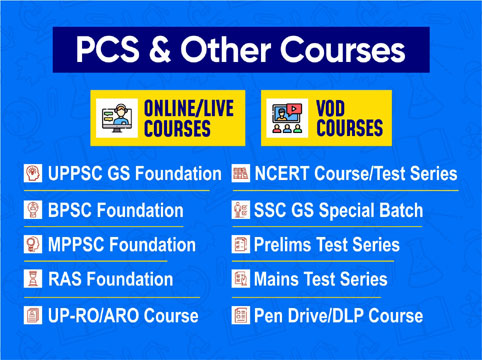

Contact Us

Contact Us  New Batch : 9555124124/ 7428085757

New Batch : 9555124124/ 7428085757  Tech Support : 9555124124/ 7428085757

Tech Support : 9555124124/ 7428085757