|

Syllabus : Prelims GS Paper I : Current Events of National and International Importance; Economic and Social Development-Sustainable Development, Poverty, Inclusion, Demographics, Social Sector Initiatives, etc.

Mains GS Paper III : Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment.

|

Context

Need of finance to drive economic growth in post Covid-19 India.

Background

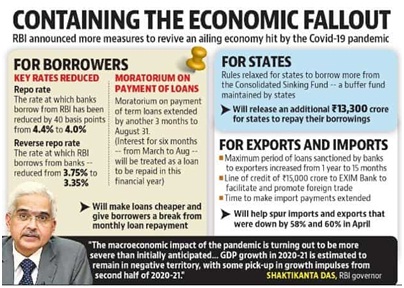

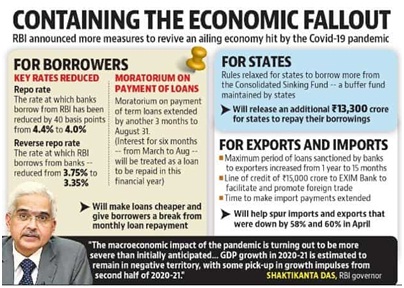

The United Nations Secretary-General termed the corona virus pandemic as the most challenging crisis since World War II and International Monetary Fund (IMF) chief declared that the COVID-19 pandemic has driven the global economy into a downturn. Some sectors even collapse completely. In this time there is a single key to revive the economy again which is the massive funding to revive the economy.

Economy In Post Lockdown India

Official data capturing the economic impact of the nationwide lockdown are coming in public spaces. The country’s industrial output, as measured by the Index of Industrial Production (IIP), contracted by 16.7% in March, according to statistics released by the government. This is in contrast to a growth rate of 2.7% witnessed during the same month last year. The sharp fall can largely be explained by the nationwide lockdown that was imposed by the Centre.

The manufacturing sector, which witnessed a contraction of about 20%, was the worst hit among the key sectors, perhaps due to disruptions in the labour market caused by the lockdown.

In terms of end-goods, capital goods and consumer durables witnessed a roughly one-third contraction in size as the sale of non-essential goods was obliterated by the unexpected lockdown.

Analysts say that industrial output is likely to fall even further due to the reciprocating effects. In fact, some estimates suggest that the economy’s overall output in the first quarter of FY21 could be cut by one-fourth and growth for the whole financial year could well turn out to be negative.

India's GDP dipped by 23.9% between April to June as the COVID-19 pandemic took hold of the economy. This is the worst that India's GDP has ever contracted is at a 24 year low. This in comparison to last year, when GDP was up by 5.2%.

The COVID-19 crisis being a temporary external shock, much like demonetisation in 2016 but much larger in scale, can theoretically lead to a quick bounce-back in economic activity but the actual pace of the recovery in industrial production and even the wider economy will depend on the policy environment created by the government after the crisis.

Essential Areas of Financing

As supply recovers while commodity prices remain constrained, there is an opportunity to switch from the low credit and money growth that characterized India’s post 2011 growth slowdown, to a credit-led recovery that also reduces the financial sector stress. Financial conditions can be relaxed, especially as essential structural improvements are adequate and over-tightening created stress.

The post Covid-19 macro-financial package could trigger a virtuous growth cycle, by raising marginal propensities to spend above those to save, as demand is kept a step ahead of gradual relaxation in supply constraints. Activating India’s large domestic demand can potentially insulate from global shocks and a likely prolonged shrinking of trade.

To improve the fiscal space and manage high levels of debt distress, a growing call for extending the debt moratorium under global initiatives like the Debt Service Suspension initiative is timely. Central banks can continue to keep the balance of supporting the economy and maintaining financial stability. This further involves enhancing tax reforms and improving debt management capacities, while using limited fiscal space to invest in priority sectors. Exploring sustainability-oriented bonds and innovative financing instruments options such as debt swaps for SDG investment should be explored further.

Fiscal space is still constrained, however. In order not to overstrain government finances, stimulus should work through the financial sector, be targeted, temporary and self-limiting. Financing schemes will have to be designed to minimise impacts on future fiscal deficits, while maximising growth revival. Fiscal stimulus can be increased to the point where reduction in debt ratios due to increased growth equals the increase in debt ratios from further borrowing. Changing the composition of expenditure and cutting flab would enhance the growth boost.

In addition to economic considerations, the policy paradigm must mainstream affordable, accessible and green infrastructure standards, while promoting social equality and environmental sustainability principles as enshrined in the Paris Agreement. As we scale up the use of digital technology and innovative applications, the financing support of micro, small and medium-sized enterprises must go hand in hand with these national job-rich recovery strategies.

As the impact fall on world over, thus the regionally coordinated financing policies are essential to restart trade, reorganise supply chains and revitalise sustainable tourism in a safe manner. Across Asia and the Pacific, governments must pool financial resources to create regional investment funds. Strengthening regional cooperation platforms to ensure that all countries receive an equitable number of doses of the vaccine on short notice to everyone everywhere is particularly essential.

Conclusion

The economic rescue measures announced by the Finance Minister, such as more loans to small and medium scale enterprises and loosed credit standards, can help the recovery by allowing businesses to find their feet soon.

But the key will lie in the implementation of these measures. Previous attempts by the Reserve Bank of India and the government to flush the system with liquidity, have failed to improve credit flow to businesses. The government must also ensure that bureaucratic red tape does not kill any nascent recovery at a time when businesses, whose balance sheets have been hit hard by the crisis, need the freedom to adjust to a new economic reality. The government should emphasis on self-reliance as its new economic agenda.

Connecting the Article

Question for Prelims

Which among the following is referred as the National Income?

(a) Net National Product at Factor Cost

(b) Net National Product at Market Price

(c) Gross National Product at Factor Cost

(d) Gross National Product at Market Price

Question for Mains

Fiscal stimulus is the key to revive economic growth in post COVID India. Discuss

Contact Us

Contact Us  New Batch : 9555124124/ 7428085757

New Batch : 9555124124/ 7428085757  Tech Support : 9555124124/ 7428085757

Tech Support : 9555124124/ 7428085757