|

Syllabus : Prelims GS Paper I : Economic and Social Development – Sustainable Development, Poverty, Inclusion, Demographics, Social Sector initiatives, etc.; Current events of national and international importance

Mains GS Paper III : Food processing and related industries in India- scope and significance, location, upstream and downstream requirements, supply chain management.

|

Context

Challenges in food processing sector due to high wastage and neglect in policy making , together with it could prove to be a key sector for the success of ‘Atmanirbhar Bharat’.

Background

The food processing industry is of enormous significance as it provides vital linkages and synergies that it promotes between the two pillars of the economy, the agriculture and the industry.

Despite being one of the largest producers of agricultural and food products in the world, India ranks fairly low in the global food processing value chains. In fact, as with the rest of India (most other sectors), this sector is also largely unorganized and informal. This results the high wastages of the food commodities. Consider this as a percentage of GDP, India’s agri exports stands at 2% only. Compare to other nations, it is 4 per cent for Brazil, 7 per cent for Argentina, the only exception here is Milk, whose level of processing stands at 35 per cent.

Strength of India's Food Processing Industry

Food processing has become an integral part of the food supply chain in the global economy, and India has also seen growth in this sector in the last few years. The sector contributes around 11% of agricultural value-added and 9% of manufacturing value-added. According to the ministry of food processing industries annual report, the sector employs 12.8% of the workforce in the organized sector (factories registered under Factories Act, 1948), and 13.7% of the workforce in the unorganized sector.

Processing can be further delineated into primary and secondary processing. Rice, sugar, edible oil and flour mills are examples of primary processing. Secondary processing includes the processing of fruits and vegetables, dairy, bakery, chocolates and other items.

Most processing in India can be classified as primary processing, which has lower value-addition compared to secondary processing. There is a need to move up the value chain in processed food products to boost farmer incomes. For instance, horticulture products, such as fruits and vegetables, carry the potential for higher value-addition when compared to cereal crops.

Key Challenges

Supply side bottlenecks: Small and dispersed marketable surplus due to fragmented holdings, low farm productivity, high seasonality, perishability and intermediation result in lack of distribution on supply and quality, and in turn, impede processing and exports.

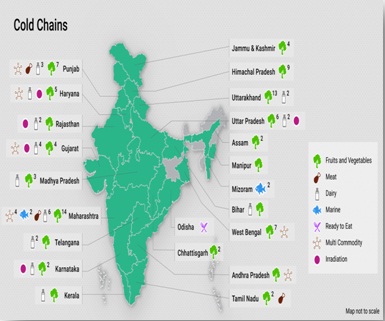

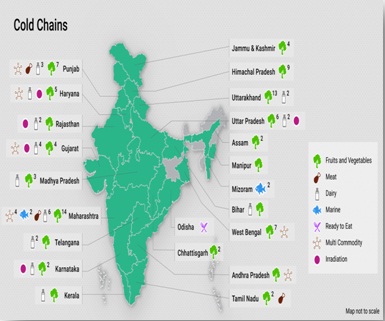

Infrastructure bottlenecks: More than 30 per cent of the produce from farm gate is lost due to inadequate cold chain infrastructure (covering only 1 per cent of total F&Vs production) and inadequate logistics. About 80 per cent of the 217 lakh tonnes cold storage capacity is engaged by potatoes while other F&Vs account for only 0.2 per cent.

Likewise, instead of using specialized transportation for perishables like reefer vans, their logistics predominantly rely on traditional modes, commonly used for grains. Yet, development of cold chains and logistics infrastructure remains an unviable investment option, on account of, lack of critical scale and high operating costs (twice than in the West).

Deficiencies in the regulatory environment: Lack of integration & clarity: Numerous laws, under the jurisdiction of different ministries and departments, govern food safety and packaging. The multiplicity of legislation leads to contradictions in specifications, conflicting approach, lack of co-ordination and administrative delays.

Lack of Holistic Approach: Despite conferring numerous incentives for establishing new processing units, proportionate results have not been achieved. This can be credited to the absence of vital peripheral infrastructural linkages and legislation for contract and corporate farming, inadequate implementation of the APMC Act and cumbersome procedures to avail grants. Also, unlike for small scale industries, fewer schemes have been designed to promote scale by incentivizing large scale investors.

Besides these, inherent anomalies such as mounting cost of finance, lack of skilled and trained manpower, inadequate quality control and packaging units and high taxes and duties, thwart development of FPI.

Food processing provides an opportunity to utilise excess production efficiently. Not just from a growth perspective, food processing is also important from the point of reducing food waste. In fact, the United Nations estimates that 40% of production is wasted. Similarly, the NITI Aayog cited a study that estimated annual post-harvest losses of close to Rs 90,000 crore. With greater thrust on proper sorting and grading close to the farm gate, this wastage could also be reduced, leading to better price realisation for farmers.

Key Solution

The need of the hour is to adopt an integrated approach to address the abovementioned tailbacks with a clear-cut focus on improving the quality and value of the output, reducing the cost of raw material for the processors, while improving the farmers' income levels.

Policy initiatives: Foster development of backward linkages crucial for securing scale and economic viability by evolving conducive regulatory framework for contract and corporate farming and encouraging commodity clusters and intensive livestock rearing.

Promote holistic development through private sector participation while expounding a robust supporting framework (as in case of MFP and MTM) with well defined roles of the participants, risk sharing mechanisms, fiscal incentives and partnership models for creation of infrastructure for logistics, storage and processing.

Stream line Regulatory Structure: Remove impediments of multiple departments and laws in seeking approvals by bringing them under a single window thereby providing clarity in roles and channels of operational and service delivery.

Orientation: Participants across the agri value- chain need to shift their focus from trying to market ‘what is produced' to producing ‘processable varieties and marketable products' meeting global quality standards and traceability requirements, duly adopting need based viable technologies and quality controls.

Human resource: Stimulate industry, academia and government to put in combined efforts for development of specialized institutes and courses for providing training on managerial, safety and enforcements, technology and production, warehousing and distribution aspects.

Government Efforts

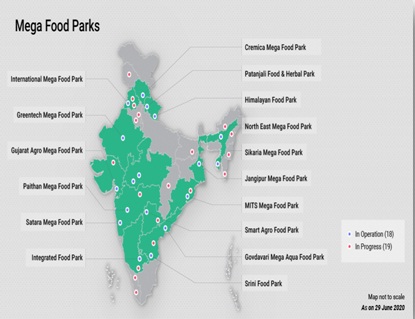

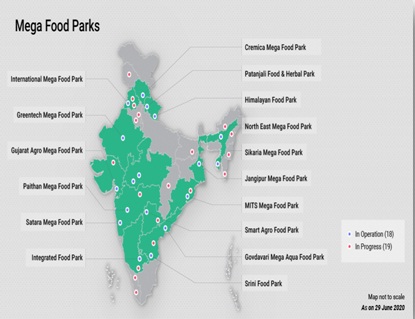

The Government of India through the Ministry of Food Processing Industries (MoFPI) is also taking all necessary steps to boost investments in the food processing industry. The government has sanctioned 39 Mega Food Parks (MFPs) to be set up in the country under the Mega Food Park Scheme. Currently, 18 Mega Food Parks have become functional.

The Government has made commendable efforts to promote investment in the industry by way of channeling resources through various schemes as subsidies and grants. The schemes included development of integrated cold chains, Mega Food Parks (MFP), Modern Terminal Markets (MTM) and bulk storage facilities as well as modernization of markets, quality control laboratories and abattoirs.

This can be attributed to the improving policy environment and increasing thrust on public-private partnership and improvement of rural infrastructure, to leverage India's strengths on the supply and demand frontiers.

Way Forward

In order to ensure sustained growth in the sector and to reduce wastages, the priority for the government should be on enhancing the cold-chain capacity, logistics infrastructure, proper ways of marketing commodities, farmer training and skilling of the workforce.

Encourage State Agricultural Universities to commence courses in food packaging, processing, bio-technology, information technology in agriculture and such allied fields.

Connecting the Article:

Question for Prelims

Consider the following statements:

1. 100% FDI is allowed under automatic route in the Food processing industry.

2. 100% FDI is allowed under government approval route for trading of food produced in India.

Which of the statements given above is/ are correct ?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Question for Mains

‘There is a point of view that gaps in the supply chain are perhaps the biggest challenge faced by the food processing sector.’ Examine

Contact Us

Contact Us  New Batch : 9555124124/ 7428085757

New Batch : 9555124124/ 7428085757  Tech Support : 9555124124/ 7428085757

Tech Support : 9555124124/ 7428085757