(MainsGS3:Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.)

Context:

- Economists and the government are hopeful that Indian households’ consumption spending would return to pre-pandemic normalcy in 2022 and help fuel a virtuous private investment revival spurring job creation.

Worsening situation:

- While the Omicron wave was less fatal than the pandemic’s preceding waves, it also didn’t take as much of a toll on the economy in 2022 as the previous two years.

- However, some of the other fear factors at the turn of the year did materialize and ended up manifesting themselves into more shocks across the globe.

- The IMF earlier projected that the Indian economy will grow at a high rate of 9% but in late February, the Russia-Ukraine war completely disrupted the supply chains, particularly for food and energy.

- Year 2022 was expected to see a pick-up in growth as well as inflation, but by the middle of the year, there was a real concern that the global economy would slip and slide into recession thanks to supply shocks.

Surge in inflation:

- While a slowdown in manufacturing and exports in recent months is a cause of worry, inflation was undoubtedly India’s bugbear of the year.

- With Russia being a key energy supplier and Ukraine a dominant player in the world market for food items like wheat and sunflower oil, fuel and food inflation translated into consumer price rise levels not seen in decades across several countries.

- India’s retail inflation which flared up to the 6% upper tolerance threshold set for the central bank in January 2022, stayed over that mark through 10 of the 11 months for which data is now available.

- The surge in inflation compelled central banks, including the U.S. Federal Reserve, to hasten unwinding of easy money policies deployed to prop up economic activity through the pandemic.

Measures to cool prices:

- The central government unveiled a slew of measures to cool prices, including a ban on wheat exports and curbs on a few other food items’ exports, with a few measures to rein in high raw material costs for industry owing to runaway commodity prices.

- Petrol and diesel prices have been frozen through most of this year, but that has also meant consumers have not gained from price resets when global crude prices fall, as they have in recent weeks.

- Vegetable prices fell dramatically in November to bring inflation below 6% for the first time this year, but cereals and pulses’ price rise continue to accelerate.

- The government expects steps to check cereals and pulses prices to be ‘felt more significantly’ in coming months, while the Reserve Bank of India expects inflation to average 5.9% in the January to March quarter.

Outlook for 2023:

- Growth expectations have fluctuated through the year as have growth rates skewed by pandemic base effects.

- However, the Indian economy has displayed a broad resilience amid strong external headwinds thanks to a consistently growing farm sector and consumers catching up on pent-up demand for contact-intensive services that have now recovered to pre-COVID levels.

- The World Bank recently scaled up its 2022-23 growth estimate to 6.9% but by all accounts, growth is expected to be slower in the coming year (2023-24) at around 6% or slightly under.

Conclusion:

- Most developed nations are expected to enter a recession, which will dent demand for India’s exports.

- Thus, maintaining macro-economic stability and building buffers to steer the economy through these external shocks while pursuing reforms to make India a reliable alternative investment venue, should keep policy makers’ hands full.

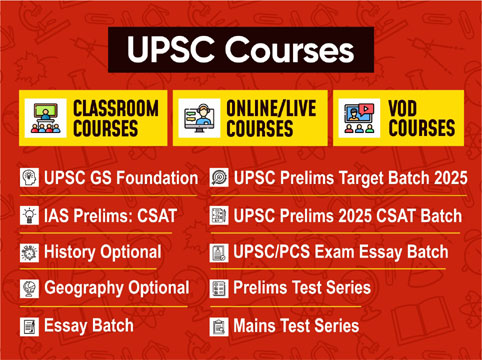

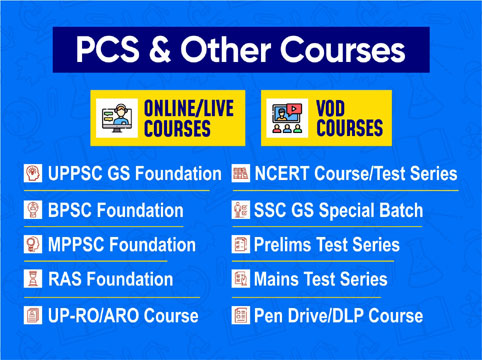

Contact Us

Contact Us  New Batch : 9555124124/ 7428085757

New Batch : 9555124124/ 7428085757  Tech Support : 9555124124/ 7428085757

Tech Support : 9555124124/ 7428085757