(MainsGS3: Effects of liberalization on the economy, changes in industrial policy and their effects on industrial growth.)

Context:

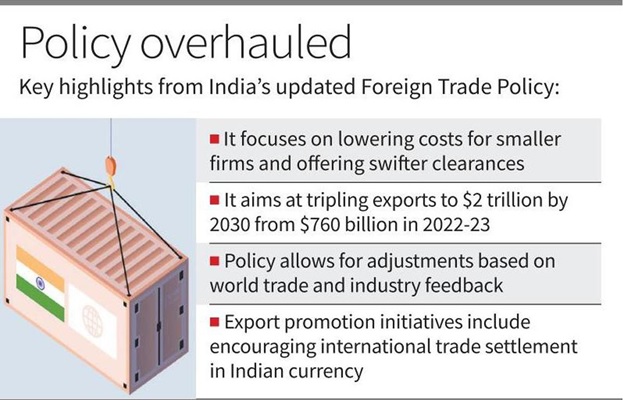

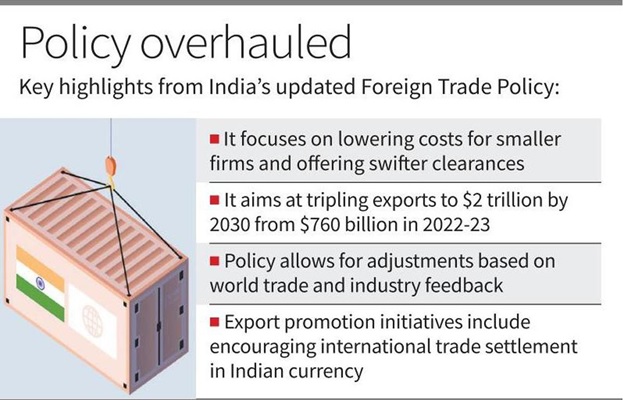

- Recently, the Union Commerce, Industry and Textiles Minister unveiled a new Foreign Trade Policy that moves away from providing incentives to exporters, but lowers a few costs for smaller firms and promises swiffer clearances, along with a one-time amnesty scheme for export obligation defaults.

About new policy:

- Replacing the extant policy that had been in place since 2015, the new policy kicks in from 2023-24 and aims to almost triple India’s goods and services exports to $2 trillion by 2030, from an estimated $760 billion in 2022-23.

- India’s exports were $435 billion in 2015-16 when the previous policy was introduced and have grown nearly 75% to an estimated $760 billion in 2022-23.

- The new policy will have no sunset date and will be tweaked based on the emerging world trade scenario and industry feedback.

- There are no major new schemes, barring a one-time amnesty under the existing Advance Authorisation and Export Promotion Capital Goods (EPCG) schemes, that allow imports of capital goods subject to specified export obligations.

New area of potential exports:

- Opening up a new area of potential exports, the policy has included “merchanting trade” within its ambit.

- Exporters in India can source goods from another country and send them to a third country without touching Indian shores.

- There is a focus on simplifying policies to facilitate export of dual-use high-end goods and technology such as UAVs [unmanned aerial vehicles], drones, cryogenic tanks and certain chemicals.

A fresh approach:

- The last three years have been unprecedented, with first the COVID-19 pandemic and then Russia’s invasion of Ukraine disrupting global trade momentum.

- Still, the last three years, when India put its trade policy reset on hold, also provided policymakers a unique opportunity to take a fresh approach to delineating the contours of its trade policy goals.

- The National Trade Facilitation Action Plan, for instance, lists aims to achieve that are essential and laudable but in no way novel: an improvement in the ease of doing business through reduction in transaction cost and time, a reduction in cargo release time, and a paperless regulatory environment.

WTO obligations:

- In a nod to India’s WTO obligations, the shift from incentives to an enabling regime of duty remission and exemption schemes to facilitate duty-free imports of inputs required for boosting exports has been near complete.

- Most of these schemes including the RoDTEP (Remission of Duties and Taxes on Exported Products), RoSCTL (Rebate on State and Central Taxes and Levies), AA (Advance Authorisation) and EPCG (Export Promotion Capital Goods) have been around for a while and the policy has just tweaked some of the terms of implementation to improve adoption.

- Further, acknowledging the substantial surge in online trade, the policy devotes a whole chapter to ‘Promoting Cross Border Trade in Digital Economy’ including moves to facilitate the establishment of dedicated e-commerce export hubs.

Conclusion:

- With global trade largely becalmed and the services sector facing headwinds of uncertainty in the key western markets, the FTP falls short in offering more substantive and sectorally targeted measures as well as a well-defined road map to meet the 2030 export target.

Contact Us

Contact Us  New Batch : 9555124124/ 7428085757

New Batch : 9555124124/ 7428085757  Tech Support : 9555124124/ 7428085757

Tech Support : 9555124124/ 7428085757