-

- All Courses

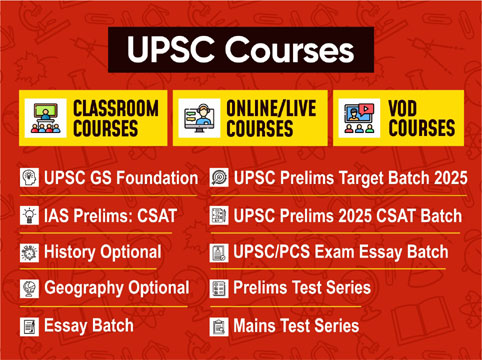

- Classroom Courses

- Mentorship Program

- English Medium Course

- UPSC Online/Live Courses

- UPSC VOD Courses

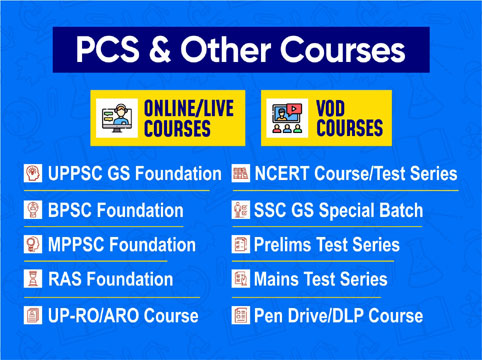

- UPPSC Online/Live Courses

- BPSC Online/Live Courses

- Other PCS Online/Live Courses

- Test Series

- UP Lekhpal Course 2026

- DLP

- NCERT Course

- General English Course

- General Hindi Course

- Other Govt. Exam

Contact Us

Contact Us  New Batch : 9555124124/ 7428085757

New Batch : 9555124124/ 7428085757  Tech Support : 9555124124/ 7428085757

Tech Support : 9555124124/ 7428085757