Prelims: Current Affairs, Indian Economy

Mains: General Studies Paper-3 (Indian Economy) |

Why in News?

Wheat and edible oil are the real inflation concerns as wheat imports have become inevitable due to low stocks and production uncertainties, while global palm oil prices are constantly rising due to Indonesia's biodiesel blending programme.

Key Points:

- Retail food inflation has declined slightly to 9.04% in the month of November.

- Vegetable inflation is expected to ease due to improved supply in winter.

- 42.23% in October

- 29.33% in November

- Two key commodities remain a cause of concern: wheat and edible oil.

Wheat and edible oil data:

- Wholesale price of wheat in Delhi is currently Rs 2,900-2,950 per quintal.

- Last year at this time it was Rs 2,450-2,500 per quintal.

- Inflation in vegetable oils was even higher, at 13.28%.

- According to data from the Department of Consumer Affairs-

- The all-India model retail price of packaged palm oil is now Rs 143 per kg.

- Prices of other oils are also higher

- Soybean (₹154 vs ₹110 /kg)

- Sunflower (₹159 vs ₹115 )

- Mustard (₹176 vs ₹135 )

Wheat-led inflation:

- India's wheat harvest has been below average in the last 3 years.

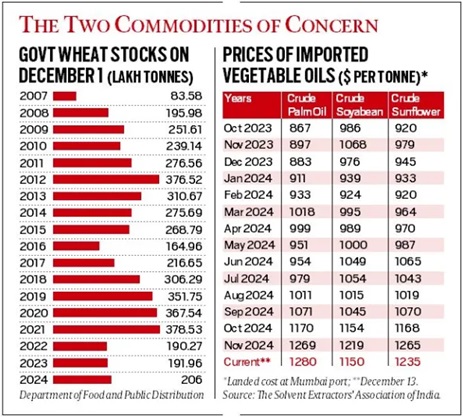

- Stocks in government warehouses are at their lowest since 2007-08.

- Domestic prices remain high despite export ban from May 2022.

- Indian farmers have sown more wheat this time.

- Higher monsoon rains have brought adequate moisture to the soil and water levels in reservoirs and Expectations of a bumper crop in 2024-25 have increased due to a possible La Nina (which usually means a longer winter).

- Wheat sown from late October will not be ready for marketing before early April.

- Of the 20.6 million tonnes of government wheat stock as on December 1, about 1.5 MT is the monthly requirement for the public distribution system.

- Apart from deducting this for the four months till March, there is a requirement to maintain a standard opening minimum stock of 7.46 MT as on April 1.

- In addition, about 7.1 MT of wheat can be offloaded in the open market during this low production period.

- In 2023-24, such open market sales from government stocks totalled 10.09 MT.

- This helped to moderate wheat prices to some extent.

- This time, not only is less wheat available for intervention in the open market, but current prices may also weaken government procurement.

- Farmers may not want to sell wheat to government agencies at the official MSP of ₹2,425/quintal as open market rates are very high.

Wheat imports can be an option:

- International wheat prices are low, making import option possible.

- Russian wheat price is around $230 per ton.

- Wheat arriving from Australia is priced at $270 per tonne from their ports of origin.

- Adding sea freight and insurance charges, their landed cost in India comes to $270-300 per tonne or Rs 2,290-2,545 per quintal.

- Close to the MSP of Rs 2,425 per quintal.

- For flour mills in South India, imported wheat will be cheaper than the grain obtained from domestic sources.

- Import of 3-4 metric tonnes will help improve domestic supply.

- Standing crops between now and April will also get protection against damage caused by climate change.

Increased inflation due to edible oil:

- Palm oil is nature's cheapest vegetable oil.

- From 20-25 tonnes of fresh fruit bunches and at 20% extraction rate, 4-5 tonnes of crude palm oil is produced per hectare.

- In contrast, soybean and mustard yields rarely exceed 3-3.5 tonnes and 2-2.5 tonnes per hectare, respectively.

- Even at 20% and 40% recovery, their oil yield is only 0.6-0.7 and 0.8-1 tonnes per hectare.

- Palm oil is the world's most produced vegetable oil.

- Palm oil 76.26 million tonnes in 2023-24

- Soybean (62.74 million tonnes)

- Mustard (34.47 million tonnes)

- Sunflower (22.13 million tonnes)

- The price of crude palm oil is usually lower than the prices of soybean or sunflower oil.

- It has seen a reversal in the last 3-4 months.

- Today, the price of imported crude palm oil in India is $1,280 per tonne.

- Crude soybean - $1,150

- $1,235 for sunflower oil

- The reason for the surge in prices is Indonesia's decision to increase the blending of palm oil in diesel from 35% to 40%.

- Indonesia is the world's largest crude palm oil producer - 43 MT

- Followed by Malaysia (19.71 MT)

- Thailand (3.60 MT)

- It plans to introduce so-called B40 biodiesel in the coming years.

- Indonesia's biodiesel blending mandate has been increased from 2.5% in 2008 to 20% in 2018.

- It will be raised to 30% in 2020

- 35% in 2023

- 40% in 2025.

- This will result in 14.7 MT of its crude palm oil production being diverted for domestic industrial use in 2024-25.

- This will reduce the country's exportable surplus.

How much can other oils compensate?

- Of India’s 25-26 MT annual edible oil consumption, palm (mostly imported) accounts for 9-9.5 MT.

- Soybean (mainly from Argentina and Brazil)

- Sunflower (from Russia, Ukraine and Romania)

- Higher imports of oil could partially offset the lower availability of palm oil.

- Palm oil imports fall from 0.87 MT in November 2023 to 0.84 MT in November 2024; while-

- Soybean (0.41 MT from 0.15 MT)

- Sunflower (0.34 MT from 0.13 MT)

- Global soybean production is projected to touch an all-time high in 2024-25.

- There are limits to the extent to which palm oil can be substituted.

- Import of crude palm, soybean and sunflower oil currently attracts a duty of 27.5%.

- It remains to be seen whether the government makes any exception for crude palm oil.